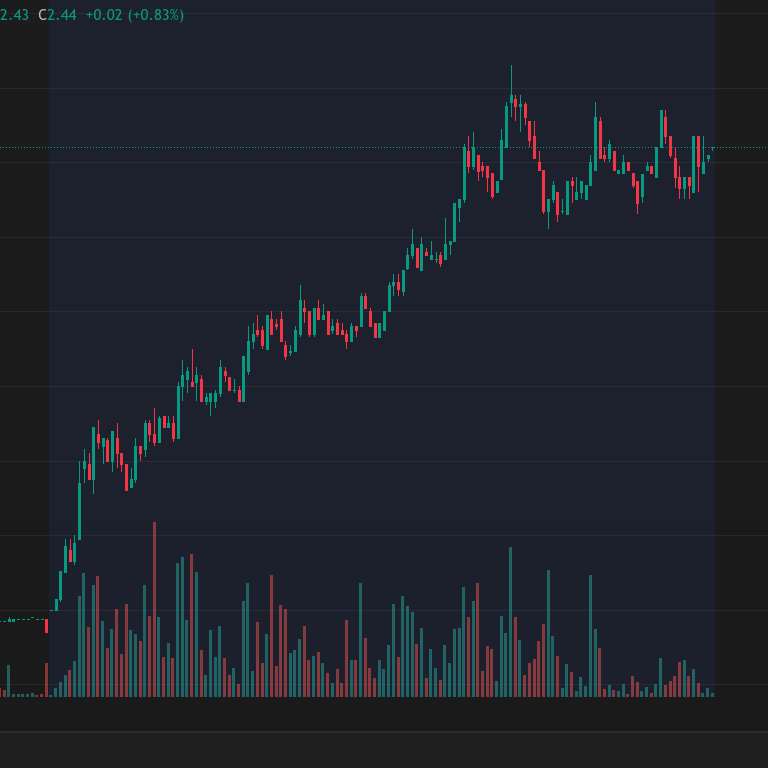

Almost every single day, a nearly forgotten NASDAQ stock suddenly explodes in after-hours trading—often doubling or tripling in value within hours, only to collapse days later. Right now, that stock is MicroAlgo Inc. (NASDAQ: MLGO), which is surging in after-hours trading with no news, no filings, and no fundamental reason behind the move.

This isn’t an isolated event. MLGO has been in a long-term downtrend, yet every so often, it experiences a rapid spike—only to give back all of its gains shortly after. This pattern is all too familiar and points to the influence of pump and dump groups manipulating low-float, low-liquidity stocks.

How Pump and Dump Groups Operate

The classic pump and dump strategy works by artificially inflating a stock’s price to attract unsuspecting traders, only to dump shares at the peak, leaving retail investors holding the bag.

1. Targeting Low-Float, Low-Volume Stocks

Pump groups focus on thinly traded stocks like MLGO, where relatively small buy orders can drive up the price dramatically. Many of these stocks trade below $5 and often have daily volumes under a few million shares before the pump begins.

2. Coordinated Buying to Trigger Momentum

Once a stock is selected, a coordinated wave of buying begins—often after hours when liquidity is lower. This creates the illusion of demand, attracting algorithms and retail traders chasing momentum.

3. Social Media and Chatroom Hype

Pump groups operate in private Discord servers, Telegram chats, and Twitter/X threads. They spread exaggerated claims about the stock’s potential, luring in traders who fear missing out.

4. Market Makers and Algorithmic Manipulation

Market makers play a role by widening bid-ask spreads, making it harder to get a fair price. Algorithms then chase breakouts, reinforcing the pump. By the time most traders hear about it, insiders are already selling.

5. The Dump: Retail Investors Left Holding the Bag

Once the stock has run up significantly, the insiders who started the pump sell their shares into the buying frenzy. The stock crashes just as quickly as it rose, leaving late buyers with heavy losses.

Why MLGO Fits the Pump and Dump Pattern

MLGO has been in a long-term decline, yet it regularly experiences short-lived spikes. Here’s what makes it a prime candidate for manipulation:

- Low Float: MLGO has a limited number of freely tradable shares, making it easy to manipulate.

- No News: The current spike comes without any new filings, contracts, or earnings beats.

- Past Pump History: MLGO has spiked multiple times before, only to collapse days later.

- After-Hours Movement: The rally began after the market closed when volume is thinner.

These are classic signs of a stock being targeted by pump and dump groups.

How to Avoid Getting Caught in a Pump and Dump

If a stock like MLGO is skyrocketing out of nowhere, it’s tempting to jump in. But these moves almost always end in a sharp reversal. Here’s how to protect yourself:

1. Research Before You Buy

Check the company’s fundamentals. If there’s no news and the stock has a history of wild swings, be cautious.

2. Watch for Insider Selling

If major shareholders are unloading shares during the run-up, that’s a red flag.

3. Avoid Trading Based on Social Media Hype

If a stock is being heavily promoted in Discord groups or on Twitter/X without any real news, it’s likely a coordinated pump.

4. Take Profits Quickly

If you do decide to trade a stock like this, don’t hold for long. The window for gains is short, and once the dump starts, it’s usually too late.

5. Recognize the Pattern

Once you understand how pump and dumps work, you’ll start recognizing the signs early. The key is to stay disciplined and avoid getting caught in the trap.

Final Thoughts

MLGO’s latest spike is another textbook example of how near-penny stocks on NASDAQ can be manipulated. With no fundamental catalyst behind the move, it’s likely a matter of time before the stock gives back its gains—just as it has in the past.

While these plays can be profitable for those who get in early and exit quickly, most retail traders end up buying near the top and holding through the crash.

If a stock is surging without a clear reason, there’s a good chance you’re watching a pump and dump in action. Stay informed, stay cautious, and don’t let hype dictate your trades.

Leave a Reply