Ah, gap-ups and gap-downs—the stock market’s equivalent of waking up to find out your favorite coffee shop is either giving away free lattes or has suddenly doubled their prices. One moment, everything is normal; the next, your stock has either taken off like a rocket or plummeted into the abyss.

For traders, gaps can be both goldmines and landmines. They offer huge opportunities for quick profits—but also brutal traps that can obliterate your trading account if you’re not careful. The trick is knowing when to jump in, when to stay out, and when to run for the hills.

So, if you’ve ever wondered how to trade gap-ups and gap-downs without getting blindsided, you’re in the right place. Let’s dive in.

What Exactly Are Gap-Ups and Gap-Downs?

Before we start talking strategy, let’s get the basics down.

A gap-up occurs when a stock opens at a higher price than its previous day’s closing price, creating a visible gap on the price chart.

A gap-down happens when a stock opens at a lower price than its previous day’s close, also forming a gap.

Gaps occur because the stock market never really “sleeps.” Pre-market and after-hours trading, earnings reports, economic news, global events, and yes, even a single Elon Musk tweet can send stock prices soaring or crashing overnight.

The Four Types of Gaps (Yes, They’re Not All the Same)

Not all gaps are equal. Some signal big opportunities, while others are nothing more than traps for overzealous traders. Knowing the difference can save you from costly mistakes.

1. Breakaway Gaps (The Game Changers)

These happen at the start of a new trend, often fueled by major news, earnings reports, or significant catalysts.

How to trade them:

- If a stock gaps above a key resistance level, it’s a sign of strength. Look for a confirmation candle (a solid continuation move) before entering long.

- If a stock gaps below a key support level, sellers may pile in, pushing the price lower.

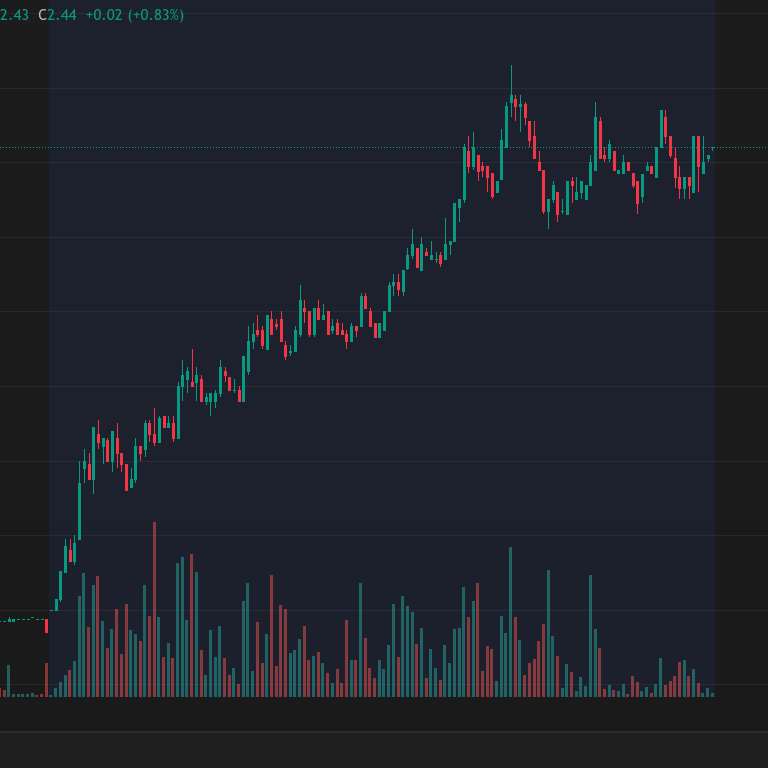

2. Runaway Gaps (The Trend Fuelers)

Think of these as momentum boosters. They occur mid-trend, reinforcing the current direction. Imagine a stock steadily climbing, then BOOM—it gaps up again.

How to trade them:

- If the uptrend is strong and supported by volume, consider buying into a small pullback.

- If you see a gap-up in a downtrend, be cautious—it could be a fakeout.

3. Exhaustion Gaps (The Party’s Over)

These occur at the end of a strong trend, often when retail traders jump in too late, only for the stock to collapse.

How to trade them:

- If volume is extremely high, it may signal that smart money is cashing out.

- Look for reversal patterns, like shooting stars or bearish engulfing candles.

4. Common Gaps (Nothing to See Here)

These are minor gaps caused by low liquidity or small news events and usually fill quickly.

How to trade them:

- Generally, you don’t. Unless they align with a bigger trend, they’re just noise.

Strategies for Trading Gap-Ups

Alright, let’s talk strategy. You wake up, check your charts, and see a massive gap-up. Now what?

1. The Gap and Go Strategy

This strategy is for high-momentum stocks that gap up and keep running.

How to execute:

- Wait for the first few minutes of trading. If the stock holds above the opening price and pushes higher, consider entering long.

- Set a stop-loss below the opening price or pre-market support.

- Target previous resistance levels or use a trailing stop.

2. The Gap Fill Strategy

Not all gap-ups hold. Many fade back down and “fill the gap” as traders take profits.

How to execute:

- Watch for a reversal signal—if a stock fails to make new highs and starts rolling over, consider a short entry.

- Target the previous day’s closing price.

- Use a stop-loss above the day’s high.

Risk Management: Don’t Let Gaps Destroy You

Gaps can double your money or blow up your trading account. Here’s how to avoid disaster:

- Use stop-losses. Always have an exit plan.

- Size your trades properly. Gaps can be wildly volatile.

- Trade the confirmation, not the hype. Not all gap-ups mean the stock will go higher.

- Check the news. Is the gap backed by real fundamentals or just short-lived hype?

- Watch volume. High volume = strong conviction. Low volume? Be skeptical.

Mastering the Gap Game

Trading gap-ups and gap-downs isn’t about guessing—it’s about understanding market psychology and reacting with precision. Some gaps are golden opportunities; others are nasty traps.

The key? Have a plan, manage your risk, and don’t chase blindly.

Whether you’re riding a breakout or shorting a fade, gaps can be some of the most profitable setups—if you know how to handle them.

Now go forth and trade wisely. And remember: the market doesn’t care how early you woke up—only how well you execute.