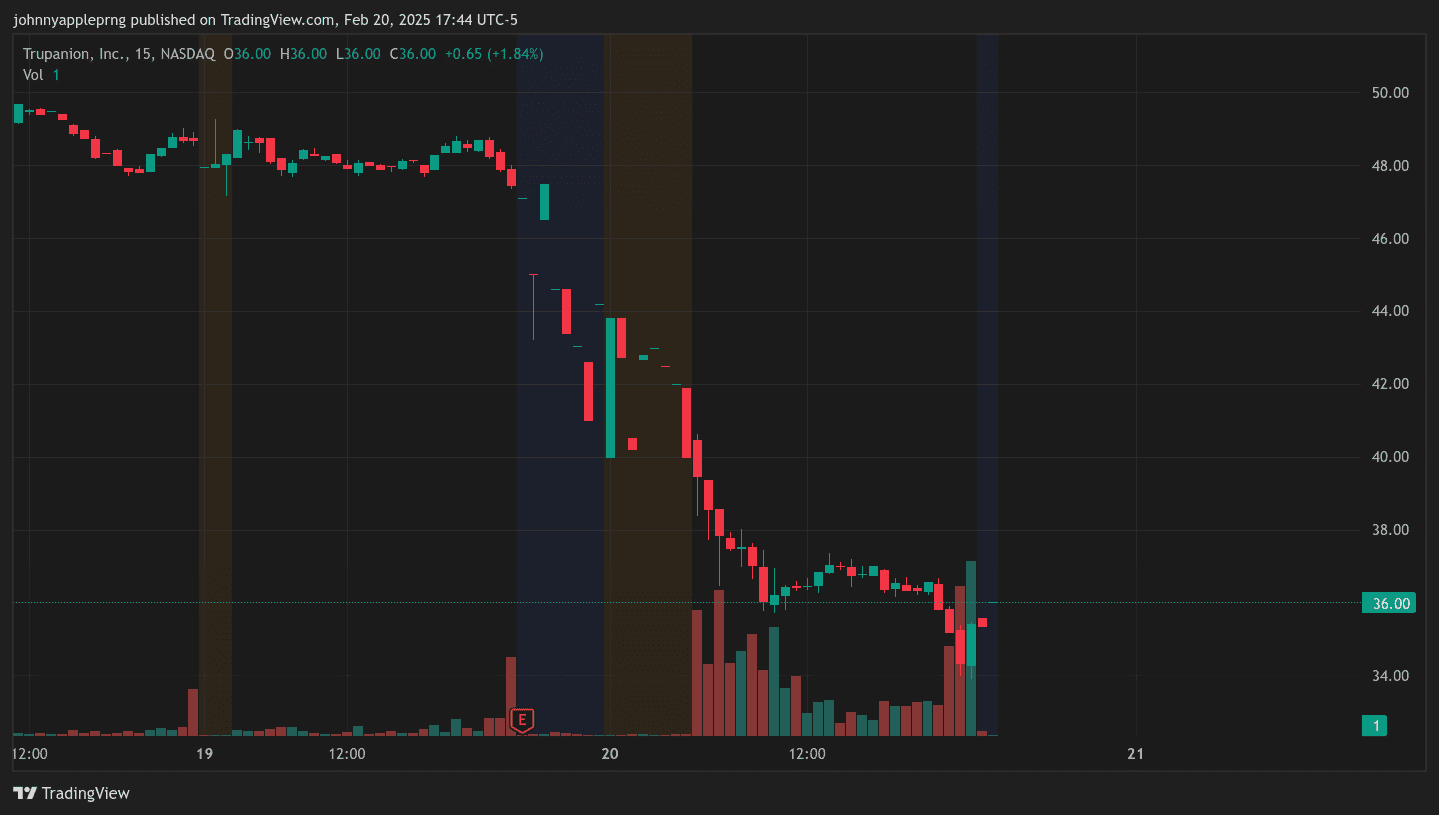

Trupanion, Inc. (NASDAQ: TRUP), a leading provider of pet insurance, saw its stock price plummet 25% today after missing earnings expectations by just $0.04 per share. The sharp selloff raises a key question for investors: Is this an overreaction or a sign of deeper trouble?

Let’s break down what happened, Trupanion’s long-term prospects, and whether this drop could be a buying opportunity.

What Triggered the 25% Drop?

Trupanion released its latest earnings report last night, revealing an earnings per share (EPS) miss of $0.04. While not a massive shortfall, the market reacted aggressively, sending the stock down 25% in a single trading session.

The reaction seems extreme, especially for an insurance company that has been steadily growing revenues for over five years. So, why the selloff?

1. Market Overreaction

We’ve seen it before: Short-term traders overreact to earnings misses, triggering large selloffs that don’t always reflect the company’s actual value.

2. Concerns Over Profitability

Trupanion has been in a high-growth phase, prioritizing market expansion over immediate profitability. Investors may be growing impatient, wanting to see stronger earnings performance instead of continued reinvestment.

3. Higher Costs and Inflation Pressures

Insurance companies rely on stable underwriting margins, but rising costs in veterinary care and pet health services could be pressuring Trupanion’s profitability outlook.

Trupanion’s Long-Term Outlook

Despite today’s selloff, Trupanion’s long-term fundamentals still look strong:

- Consistent Revenue Growth – Trupanion has grown revenues year-over-year for more than five years, tapping into the booming pet insurance industry.

- Growing Pet Ownership Trends – The market for pet insurance continues to expand as veterinary costs rise and pet owners seek financial protection.

- Strong Market Position – Trupanion is one of the most recognized brands in pet insurance, giving it a competitive advantage.

As long as Trupanion continues to acquire new customers and improve its profitability, the stock could rebound strongly over time.

Buying Opportunity or Caution Sign?

At a 25% discount, Trupanion could be an attractive entry point for investors who believe in the company’s long-term growth.

However, risks remain:

- Profitability concerns – Can Trupanion turn growth into sustainable earnings?

- Market volatility – Is this a short-term dip, or part of a larger downtrend?

- Rising costs – Will inflation and higher vet bills hurt margins further?

For those on the sidelines, this could be a chance to buy at a discount. But as always, do your own due diligence.

For more information on Trupanion, check out its Wikipedia page.