Xos, Inc. (NASDAQ: XOS) is on fire. The stock has surged over 100% in a single day following a major announcement that its Xos Hub™ mobile EV charger is now listed on the General Services Administration (GSA) Schedule, making it easier for government agencies to buy.

But this isn’t just about a press release.

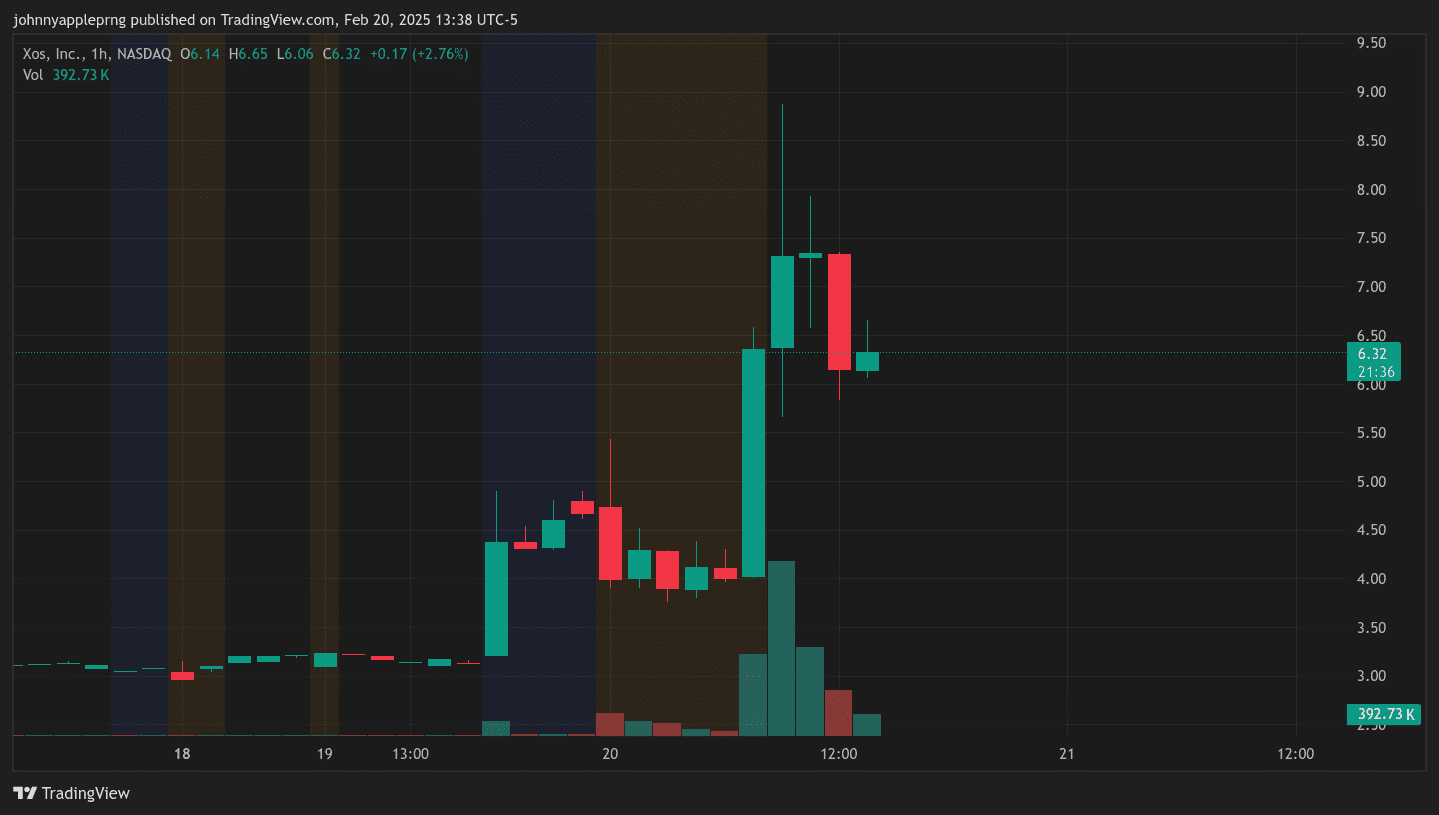

With XOS trading at $6.30 and resistance at $7.50, traders are wondering: Is this just the beginning? If momentum continues, this could turn into a full-blown short squeeze.

Why Did XOS Explode 100%?

The move was triggered by a game-changing announcement: Xos Hub™ is now on the General Services Administration (GSA) Schedule. This allows federal agencies to purchase their mobile EV charging units directly, cutting through bureaucratic red tape.

Why this matters:

- Government contracts mean huge revenue potential.

- Fleet electrification is growing fast, and Xos now has an easier way to sell into that market.

- The GSA listing removes purchasing barriers for state, federal, and municipal agencies.

But this isn’t just about fundamentals. The setup for a short squeeze is now in place.

XOS Has the Perfect Short Squeeze Setup

We’ve seen this before. Stocks with low float, high short interest, and sudden catalysts can go parabolic when traders pile in.

Here’s why XOS fits the profile:

1. A Low Float Means Big Price Swings

XOS has a relatively small float, meaning there aren’t many shares available to trade. When volume surges, even a small amount of buying can push the price up aggressively.

With today’s massive volume, XOS is moving like a true momentum stock.

2. Shorts Are Getting Squeezed

Many traders were betting against XOS before this announcement. A 100% price surge means short sellers are being forced to cover their positions, which creates even more buying pressure.

3. Retail Traders Are Jumping In

Short squeezes thrive on FOMO and momentum. We saw it with GameStop (GME), AMC, and HKD. Now, XOS is getting attention from traders looking for the next big squeeze.

If social media catches on, this could turn into a multi-day runner.

Key Levels to Watch

For XOS to continue running, it needs to break through key technical levels.

Support:

- $5.80 – A key pullback zone where buyers have stepped in.

- $4.80 – The breakout level from yesterday’s session.

Resistance:

- $7.50 – A major resistance zone from past trading history.

- $10.00 – If momentum continues, this is the next psychological level.

If XOS breaks $7.50 with volume, the short squeeze could accelerate.

How to Trade a Potential Short Squeeze

Short squeezes can be explosive but also unpredictable. Here’s how traders are approaching XOS:

- Breakout Traders: Watching for a strong move above $7.50.

- Dip Buyers: Looking for pullbacks to $5.80 or $4.80 for entries.

- Momentum Traders: Riding the trend but setting stop-losses in case of a reversal.

Timing is everything—if the squeeze picks up steam, things could move fast.

Final Thoughts: Is XOS the Next Big Short Squeeze?

XOS has all the right ingredients for a major rally:

- A real catalyst (government contract potential).

- High short interest (squeeze setup).

- Retail momentum (FOMO kicking in).

The question is: Will it break $7.50 and keep running? Or will short sellers regain control?

Traders should watch for:

- Volume spikes as XOS approaches key resistance.

- Social media buzz increasing (more traders piling in).

- Any signs of shorts covering (accelerated buying pressure).

If momentum holds, XOS could turn into a full-blown short squeeze.

Leave a Reply