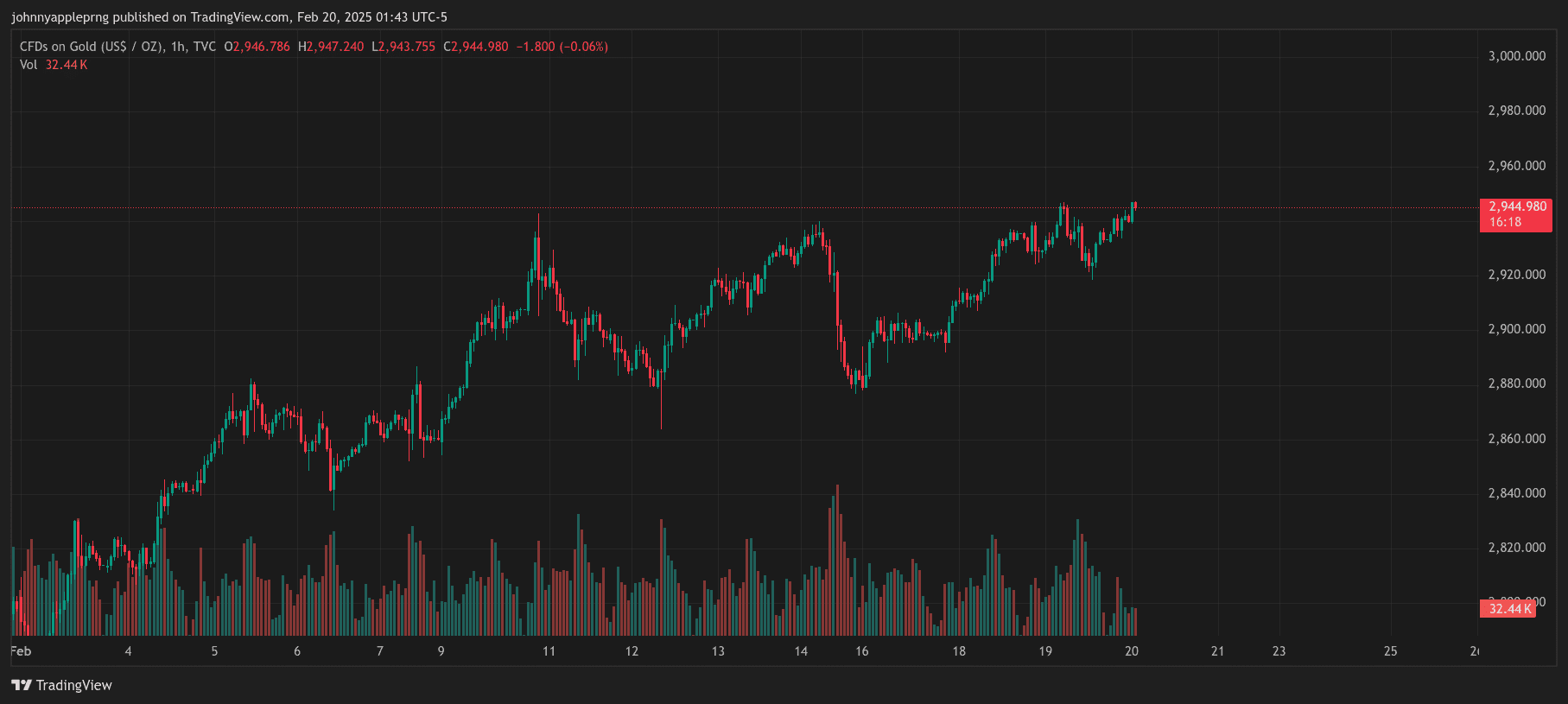

Gold is rapidly approaching the $3,000 per ounce mark—a critical psychological level that could dictate the next major move. Over the past week, gold has been making higher highs and higher lows, signaling strong bullish momentum. But history shows that major round numbers like this often act as key decision points in price action.

Psychological levels influence market behavior because they are widely watched by traders, institutions, and even casual investors. The question now is: Will gold break through and enter price discovery, or will it face a strong rejection?

Why Psychological Levels Matter in Trading

Psychological resistance levels are price points that traders instinctively recognize as significant. Large round numbers—such as $3,000 for gold, $100 for oil, or 50,000 on the Dow Jones—tend to attract major attention.

These levels often create:

- Increased order flow – Many traders place buy or sell orders at round numbers, causing price reactions.

- Emotional market behavior – Investors hesitate at major milestones, leading to either breakouts or rejections.

- Self-fulfilling price action – Because everyone is watching, price tends to behave in predictable ways.

In strong bull markets, breaking through a major round number can act as a catalyst for further gains.

Gold’s Technical Setup at $3,000

Gold has been in a clear uptrend, and recent price action suggests that momentum is building:

- Higher highs and higher lows – The trend remains bullish.

- Multiple attempts at $3,000 – Price is testing resistance again.

- Increased volume – Buying pressure is rising.

Each rejection from $3,000 has been followed by strong rebounds, suggesting that buyers remain in control. A breakout could unlock further upside.

How Markets React to Psychological Barriers

When an asset approaches a major psychological level, three common scenarios play out:

Breakout Confirmation

- Price breaks through $3,000 with strong volume.

- Momentum traders and algorithms push the price higher.

- Gold enters price discovery, targeting $3,050–$3,100.

A clean breakout could set the stage for a sustained bull run.

Rejection and Pullback

- Gold touches $3,000 but fails to hold.

- Sellers step in, driving price back toward $2,880.

- Market consolidates before another attempt.

This would not necessarily be bearish—consolidation often strengthens the next breakout.

False Breakout Trap

- Gold briefly moves above $3,000.

- Sellers absorb demand, pushing price back down.

- Traders get caught in a bull trap, leading to further downside.

False breakouts often trigger sharp reversals, so confirmation is key.

Key Support and Resistance Levels

Resistance Levels:

- $3,000 – Key psychological level.

- $3,050–$3,100 – If gold clears $3,000, this is the next upside target.

Support Levels:

- $2,880 – Nearest short-term support.

- $2,800 – A strong floor where buyers have stepped in before.

Final Thoughts: Watch the Breakout or Breakdown

Gold’s approach to $3,000 is a critical moment. Traders should watch for:

- A strong daily close above $3,000.

- Increased volume supporting a breakout.

- Price holding above $2,950 if rejected.

Psychological resistance can create hesitation, but once broken, it often leads to strong follow-through. If gold clears $3,000, the next target is $3,050–$3,100. If it gets rejected, a pullback toward $2,950 or $2,900 could provide a buying opportunity.

With momentum building, this is a key moment for gold traders to watch.

Leave a Reply