Saving money feels safe. Borrowing money feels risky. That’s why most people assume debt is bad and that the smartest path to wealth is through saving and avoiding debt.

But if that were true, why do the rich use debt strategically while the poor focus on saving?

It’s not just about income—it’s about how money is used. The wealthy understand something most people don’t: not all debt is bad. In fact, the right kind of debt can be a powerful tool for building wealth faster.

Why the Poor Avoid Debt and the Rich Embrace It

Most people are taught from a young age: Avoid debt at all costs. Pay off your loans. Save for the future.

That advice makes sense for bad debt—things like credit cards, high-interest personal loans, and payday loans that destroy wealth.

But the rich don’t see all debt as bad. Instead, they separate it into two categories:

- Bad Debt: Debt used to buy things that lose value (car loans, credit cards, consumer debt).

- Good Debt: Debt used to acquire assets that produce income (real estate, businesses, investments).

While the poor work hard to avoid all debt, the rich leverage good debt to buy assets that generate wealth.

How the Rich Use Debt to Get Richer

The wealthy use other people’s money (OPM) to create more wealth. Here’s how:

1. Real Estate Investing

The rich don’t buy houses with cash—they use mortgages to acquire rental properties.

Example: A real estate investor buys a $500,000 rental property with 20% down ($100,000) and finances the rest with a mortgage.

- The rental income covers the mortgage payments.

- The property appreciates in value over time.

- Meanwhile, the investor keeps $400,000 in capital free to buy more properties.

Instead of saving for years to buy one house outright, they use leverage to buy multiple properties, increasing their wealth much faster.

2. Business Growth Through Loans

Wealthy entrepreneurs don’t start businesses with their own cash—they use business loans, lines of credit, and investor capital.

Example: Instead of using $100,000 of their own money to open a store, a business owner takes a loan, keeps their cash, and uses the loan to scale operations faster.

- If the business succeeds, the revenue far outweighs the loan cost.

- If the business fails, they still have capital for their next venture.

The poor fear debt. The rich use smart debt to accelerate wealth creation.

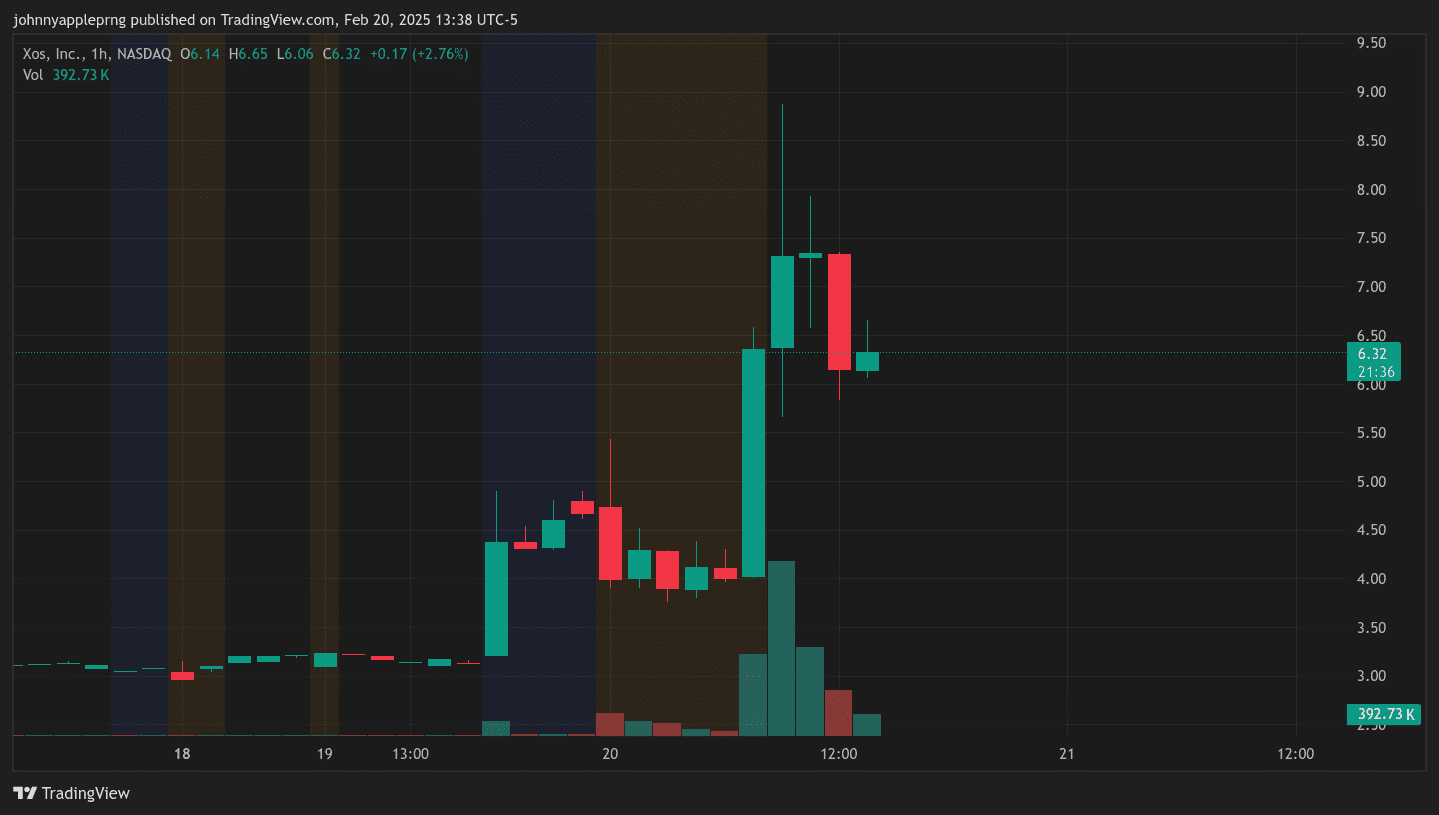

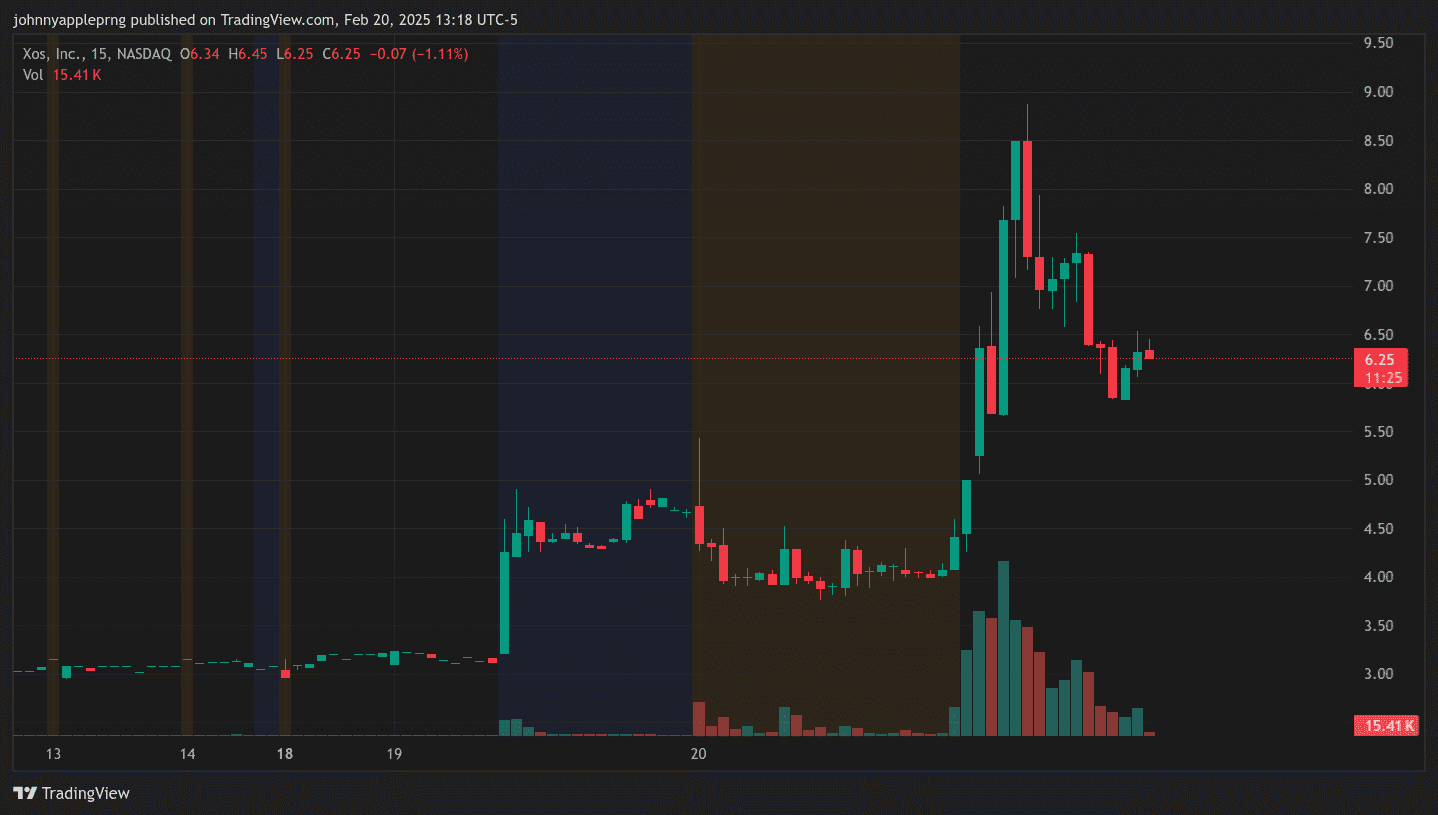

3. Stock Market Leverage (Margin Investing)

Rich investors use margin accounts to borrow money for stock investments.

Example: A trader with $50,000 in their brokerage account can borrow another $50,000 using margin, doubling their purchasing power.

If the market moves in their favor, they make higher returns than if they had only used their own cash.

Warning: Margin trading is risky, but it’s a tool the rich use to increase their exposure to high-return assets.

Why Saving Alone Won’t Make You Rich

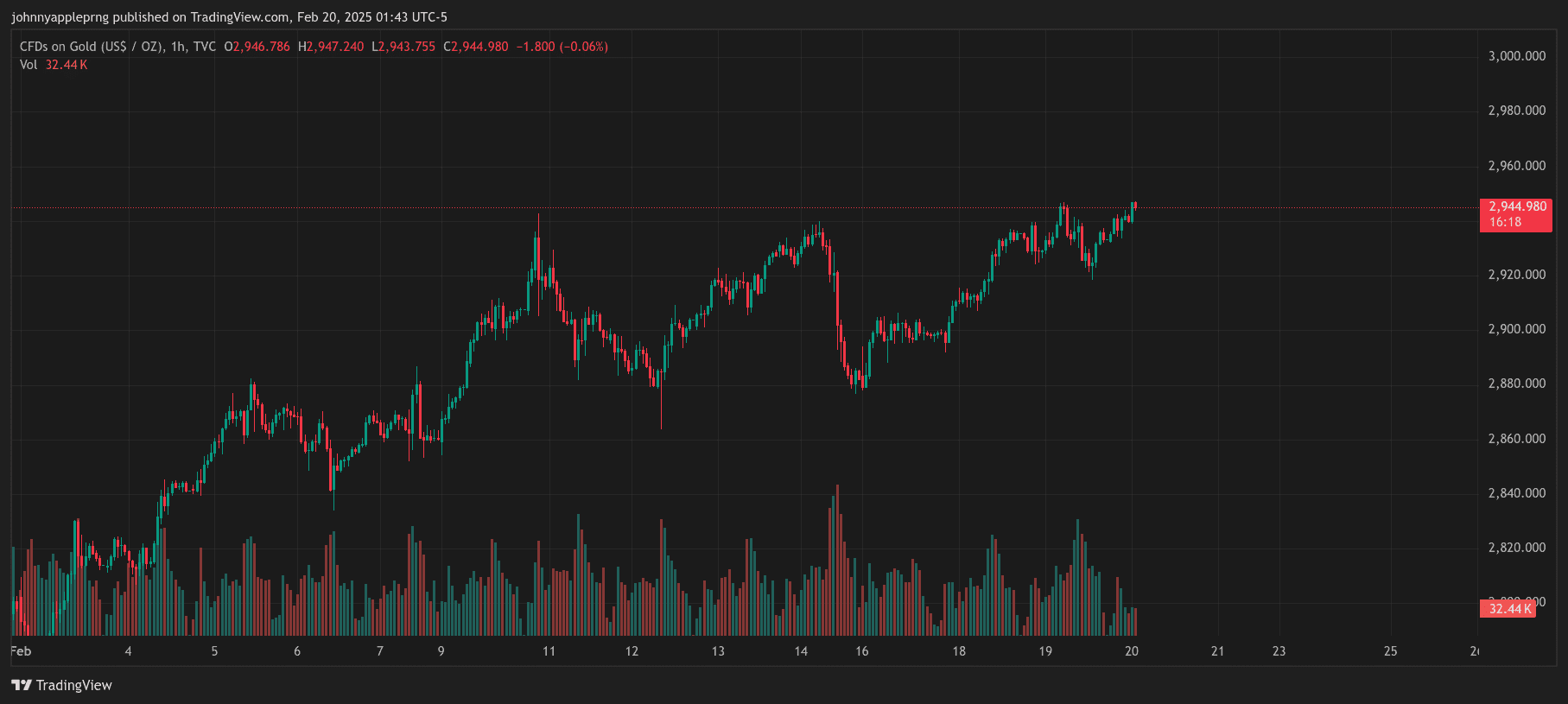

The problem with only saving money is that inflation erodes its value over time.

- If you save $100,000 and inflation is 5% per year, your purchasing power drops to $95,000 next year.

- Meanwhile, the wealthy invest in real estate, businesses, and stocks that outpace inflation.

Saving is important, but on its own, it won’t create wealth.

The Middle-Class Trap: Paying Off Debt Too Fast

Most middle-class workers focus on paying off all debt as quickly as possible—even low-interest debt like mortgages.

Meanwhile, the wealthy don’t rush to pay off cheap debt if they can get higher returns elsewhere.

Example:

- A homeowner has a 3% mortgage but extra cash.

- Instead of paying off the mortgage early, they invest the money in stocks averaging 8-10% returns.

- By doing this, they earn more money than they save on interest.

Paying off debt aggressively feels safe, but it’s not always the smartest move.

How to Use Debt the Smart Way

The key difference between rich debt and poor debt is how it’s used.

Smart debt:

- Funds income-producing assets (real estate, businesses, stocks).

- Has a low interest rate relative to investment returns.

- Is used with a clear plan to generate positive cash flow.

Dumb debt:

- Funds liabilities (cars, clothes, vacations).

- Has a high interest rate (credit cards, payday loans).

- Is taken out without a plan for repayment.

If debt is making you richer, it’s an asset. If debt is making you poorer, it’s a liability.

Final Thoughts

The rich don’t fear debt—they use it strategically. The poor and middle class avoid debt entirely, which keeps them from leveraging wealth-building opportunities.

It’s not about borrowing recklessly—it’s about using smart debt to buy assets that generate income and appreciation.

The question isn’t “Should I borrow money?”—it’s “Will this debt make me richer or poorer?”