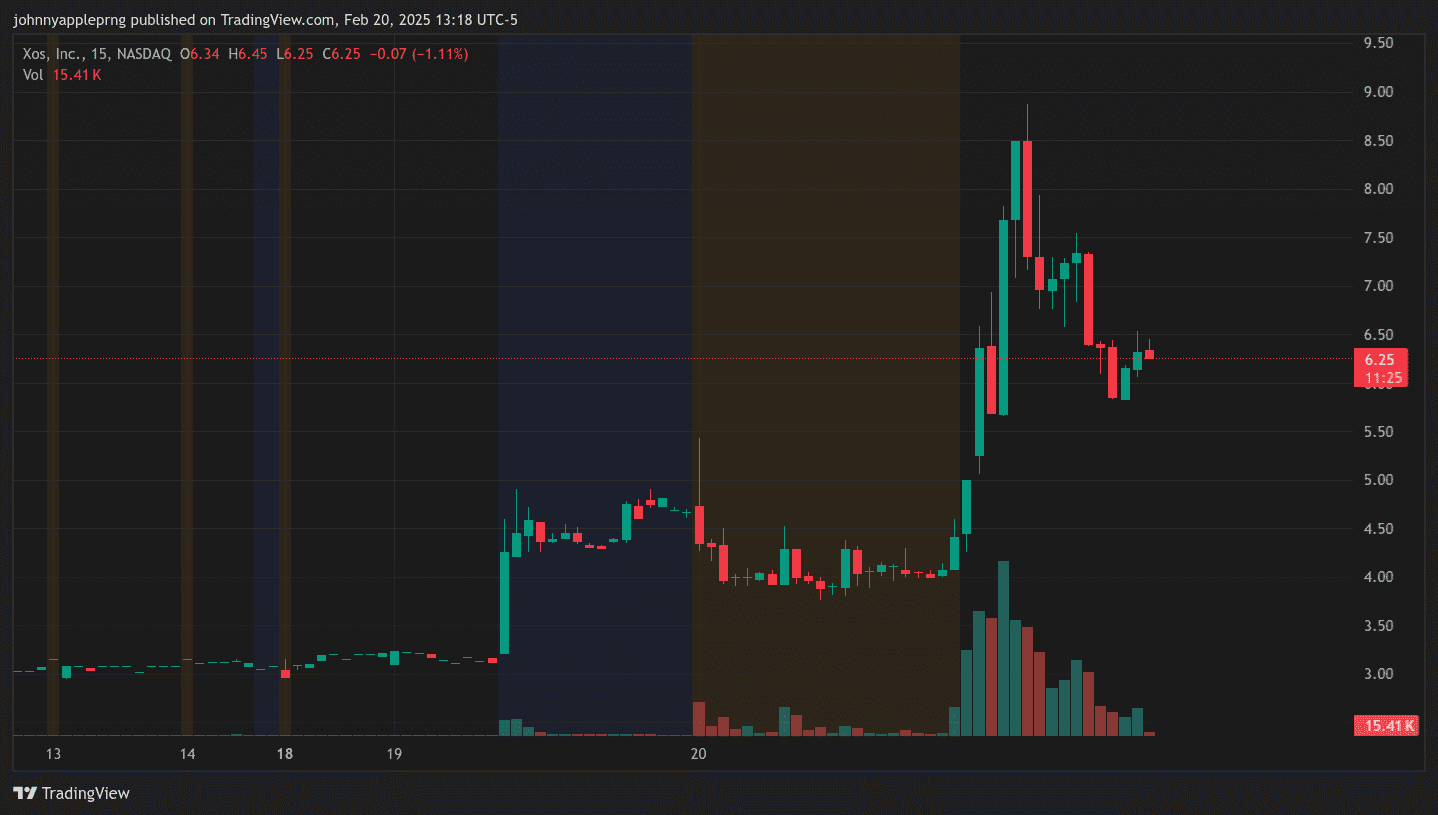

Xos, Inc. (NASDAQ: XOS), a company specializing in electric commercial vehicles and fleet charging solutions, is on fire. The stock surged 100% following a major press release announcing that its Xos Hub™ has been listed on the General Services Administration (GSA) Schedule, opening the door for government agencies to purchase its mobile EV charging units.

Why is this such a big deal? Let’s break it down.

What Does Xos, Inc. Do?

Xos, Inc. is an American manufacturer of electric commercial vehicles (EVs) and mobile EV chargers. Founded in 2016 and going public in 2021, Xos specializes in electric step vans, medium-duty trucks, and EV charging solutions.

Its key customers include major players like UPS, FedEx Ground operators, and armored transport company Loomis. To date, Xos has delivered over 600 vehicles and is expanding its lineup with new truck models and innovative charging infrastructure.

But today’s rally isn’t about their trucks—it’s about their Xos Hub™.

What Is the Xos Hub™ and Why Does It Matter?

The Xos Hub™ is a mobile, trailer-mounted EV charging unit that provides rapidly deployable charging for fleet operators. Instead of waiting months (or years) for traditional EV charging infrastructure, businesses and government agencies can deploy a Hub in a single day.

The Xos Hub™ is designed for:

- Fleets that need immediate EV charging without expensive infrastructure upgrades.

- Remote or emergency charging (disaster response, military, or temporary fleet expansions).

- Companies that lease property and can’t install permanent chargers.

- Backup power solutions during grid outages.

Here’s the key: Government agencies can now purchase the Xos Hub™ directly through the GSA Schedule, an online procurement system that streamlines federal buying. This means agencies don’t have to go through the usual bureaucratic hurdles to approve a purchase—they can simply order it like an Amazon product.

Why This News Sent XOS Stock Soaring

Government contracts can be a game-changer for small-cap companies. Here’s why:

- Instant Credibility – Being listed on the GSA Schedule validates Xos as a serious EV solutions provider.

- Huge Market Potential – Federal agencies are under pressure to meet sustainability goals, and fleet electrification is a major part of that push.

- Fast-Track Sales – The GSA listing removes red tape, allowing agencies to buy without slow-moving contract negotiations.

- First-Mover Advantage – The Xos Hub™ is unique in the market, giving Xos a lead in mobile charging solutions.

The market clearly saw the potential, with XOS shares doubling in value overnight.

The Bull Case for XOS Stock

Let’s talk about why this could be the start of something much bigger for Xos.

1. Government Contracts Could Drive Recurring Revenue

Getting listed on the GSA Schedule is a major foot in the door, but it’s just the beginning. If federal agencies start placing orders, Xos could land multi-million dollar contracts for both its charging hubs and vehicles.

Federal agencies, state governments, and even municipalities can purchase through the GSA system. The more exposure Xos gets, the bigger the potential pipeline.

2. EV Infrastructure Demand Is Booming

The biggest bottleneck in EV adoption isn’t vehicle production—it’s charging infrastructure. Installing permanent chargers requires permits, utility upgrades, and months of waiting. The Xos Hub™ bypasses all of that.

Fleets that need an immediate EV solution now have a plug-and-play option.

3. Xos Has Real Customers, Not Just Hype

Unlike some EV startups that rely on future promises, Xos already has major clients like UPS and FedEx Ground operators. The company has delivered more than 600 vehicles and is expanding its product lineup.

Now, with the ability to sell to federal agencies, Xos could significantly scale its revenue.

4. Potential Short Squeeze

Before this news, XOS stock was heavily shorted. Now that it has surged 100% in a single day, short sellers may be forced to cover, driving the price even higher.

If momentum continues, this could turn into a full-blown short squeeze.

Risks to Consider

While the bull case is strong, there are still risks:

- Xos is a small company and will need to prove it can turn this milestone into actual revenue growth.

- The EV industry is highly competitive, and larger players could enter the mobile charging space.

- Government sales cycles can be slow, and actual orders may take time to materialize.

That said, this announcement puts Xos in a completely different category than it was before.

Final Thoughts: Is XOS a Buy?

Xos has just taken a massive step forward in the EV sector. Being listed on the GSA Schedule opens up an entirely new market and gives the company a real shot at landing major government contracts.

With EV adoption accelerating, and charging infrastructure still a bottleneck, the Xos Hub™ fills a critical gap in the market.

The market reaction—a 100% gain in a single day—shows that investors understand the significance of this milestone.

Now, the key question is: Will government agencies start placing large orders?

If they do, Xos could be a sleeper stock with serious upside potential.

Traders should watch for:

- Follow-up announcements on government orders.

- Institutional buying as the stock gains credibility.

- Short squeeze potential if momentum continues.

For now, XOS is officially on the radar as one of the hottest stocks in the EV space.

Leave a Reply