For decades, speculation has surrounded Fort Knox and whether the U.S. gold reserves are actually intact. Now, for the first time since 1953, a sitting U.S. president is demanding answers.

President Donald Trump, back in office for his second term, has announced an official visit to Fort Knox to verify the nation’s gold reserves. This move follows increasing public skepticism, fueled by none other than Elon Musk, who has been advocating for a gold audit through his newly appointed role as head of the Department of Government Efficiency (DOGE).

With Trump backing Musk’s push for transparency, the financial world is bracing for what could be one of the most disruptive moments in U.S. economic history.

How Much Gold Should Be in Fort Knox?

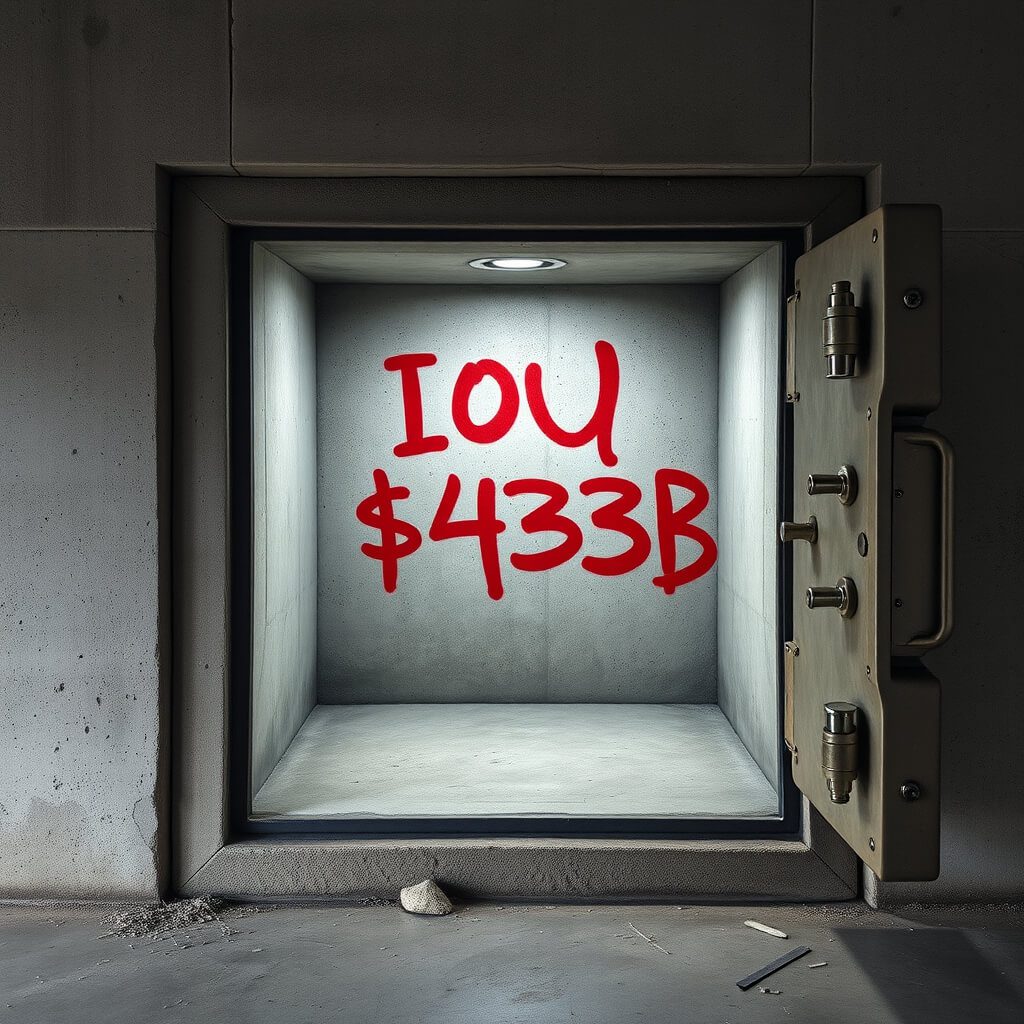

The U.S. Treasury claims that Fort Knox holds 147.3 million ounces of gold, currently valued at $2,945 per ounce. This would put the total reserves at over $433 billion.

But serious doubts remain:

- The last full audit was in 1953. No independent verification has been allowed since.

- Multiple administrations have avoided transparency. Calls for an audit have been ignored for decades.

- Theories persist that U.S. gold has been sold, leased, or used in secret financial deals.

If Trump and Musk confirm that Fort Knox is empty or significantly short, the financial consequences could be catastrophic.

What Happens to Gold Prices If Fort Knox Is Empty?

Gold is already trading at historic highs of $2,945 per ounce. If the reserves are missing, we could see an immediate surge to $5,000+ per ounce as investors rush for safe-haven assets.

Potential market reactions:

- Gold could explode beyond $5,000 per ounce. A panic-driven surge could send prices to record levels.

- Silver could follow, potentially reaching $100+ per ounce. If confidence in gold reserves collapses, silver could rally as a secondary hedge.

- The U.S. dollar could face serious devaluation. Trust in the dollar is partially based on the assumption that the U.S. holds real reserves.

- Other nations may start repatriating their gold. Countries storing gold in the U.S. (such as Germany) may demand immediate withdrawal.

The implications would be global, affecting all major financial markets.

How the Stock Market Could React

A missing U.S. gold reserve would represent a financial earthquake. The impact on U.S. markets could play out in several ways:

- Bank stocks could collapse. If trust in reserves is lost, banking liquidity could become a major issue.

- Gold mining stocks could skyrocket. Miners would benefit from surging gold demand.

- Tech and growth stocks could struggle. Riskier assets tend to suffer in financial uncertainty.

If the gold is missing, it could trigger a global selloff in U.S. assets.

Geopolitical Consequences: A New Financial World Order?

If Trump’s audit reveals that Fort Knox is empty, the consequences could extend far beyond U.S. markets.

- China and Russia may push for an alternative global reserve currency. Both nations have been stockpiling gold aggressively.

- U.S. financial credibility could be shattered. Global investors may move away from the dollar as a store of value.

- There could be international calls for a new gold-backed currency system.

This wouldn’t just be a financial crisis—it could be a complete shift in global economic power.

What If the Gold Is There?

If Trump’s audit confirms that Fort Knox’s reserves are fully intact, markets may see a brief dip in gold prices as speculation unwinds. However, the mere fact that this audit is happening at all will set a precedent for greater financial transparency.

Potential outcomes if reserves are confirmed:

- Gold may decline slightly. Speculative uncertainty would be removed.

- The dollar could strengthen. Confidence in U.S. reserves would be reaffirmed.

- Markets could rally. Reduced systemic risk could improve sentiment.

Even if the reserves are intact, the fact that Trump and Musk felt the need to verify them speaks volumes about the rising distrust in government finances.

Final Thoughts: What to Watch Next

Trump’s move to audit Fort Knox will be one of the most watched financial events of the decade. Investors should monitor:

- Any official confirmation of an audit beyond Trump’s visit.

- Market reactions, particularly in gold and currency markets.

- International responses, especially from China and Russia.

If Fort Knox is empty, this could be one of the biggest financial scandals in U.S. history. Either way, the gold markets are about to get very interesting.

Leave a Reply