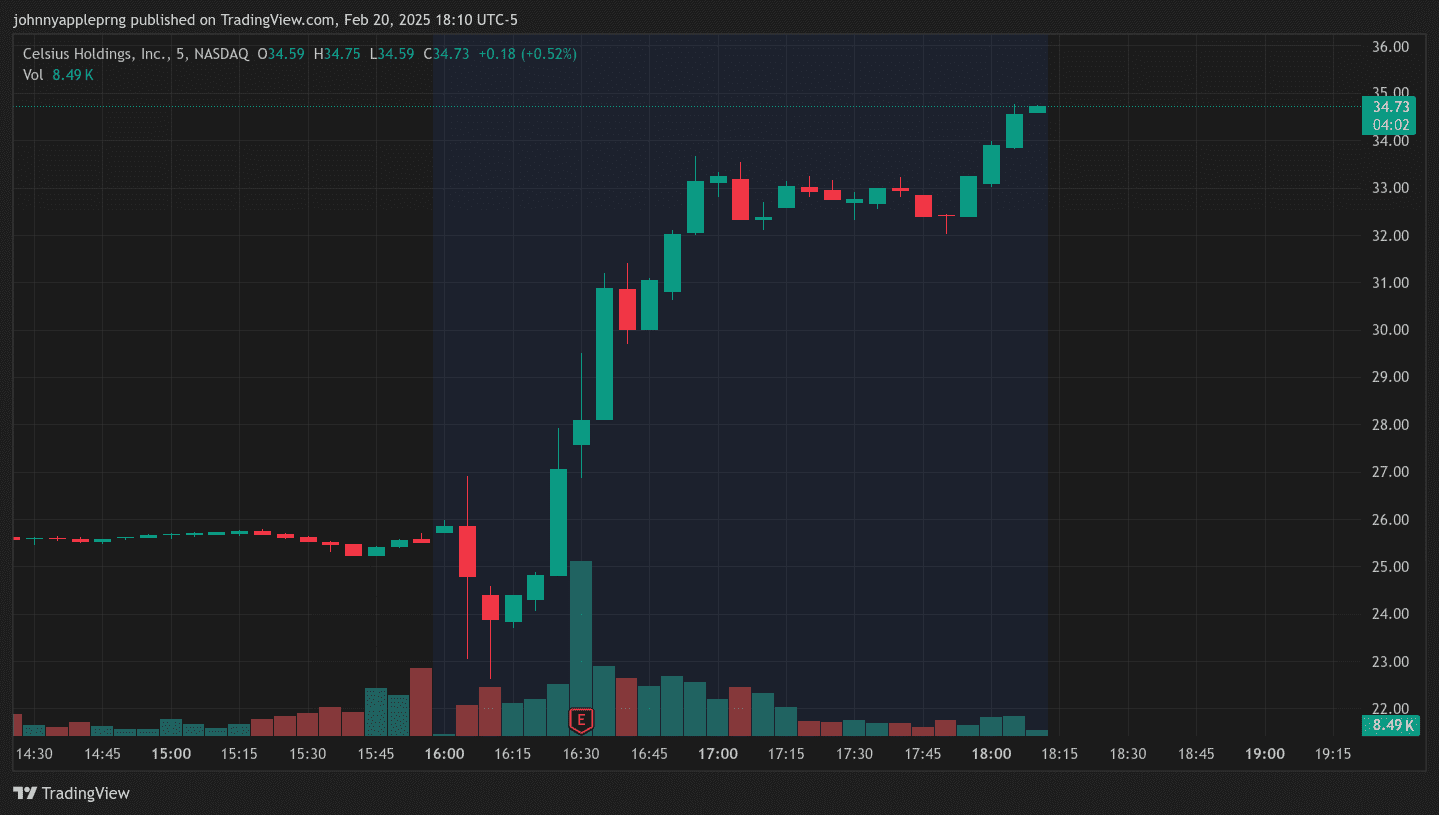

Celsius Holdings, Inc. (NASDAQ: CELH) saw its stock surge more than 20% in after-hours trading following the release of its fourth-quarter earnings report and a major acquisition announcement. The energy drink company exceeded analyst expectations, posting strong financial results while also unveiling a $1.8 billion deal to acquire rival energy drink brand Alani Nu.

The stock initially dipped after hours but quickly rebounded, bouncing off $22 per share and surging past $34 per share as investor confidence in Celsius’ long-term growth story was reignited.

Fourth Quarter Earnings Overview

Celsius reported the following financial results for the fourth quarter of 2024:

- Revenue: $332.2 million (compared to $347.4 million in Q4 2023, a 4% decline)

- Gross Margin: 50.2% (up from 47.8% in the prior year)

- Net Income: -$18.9 million (compared to $50.1 million in Q4 2023)

- Adjusted EPS: $0.14 (compared to analyst expectations of $0.11)

- International Sales Growth: 39% year-over-year

Despite a slight revenue decline, Celsius managed to expand its gross margin, signaling improved cost efficiencies. The company highlighted strong consumer demand for functional energy drinks and a growing retail presence.

Why the Alani Nu Acquisition Matters

Alongside its earnings report, Celsius announced the acquisition of Alani Nu, a fast-growing energy drink brand with a strong following among Gen Z and millennial consumers. The deal, valued at $1.8 billion, includes $150 million in tax benefits for a net purchase price of $1.65 billion.

Key strategic benefits of the acquisition include:

- Expanded Market Reach: Alani Nu has built a loyal customer base through social media marketing and influencer partnerships, allowing Celsius to tap into a new demographic.

- Complementary Branding: Celsius focuses on fitness-conscious consumers, while Alani Nu appeals to wellness-focused female consumers, creating a diversified energy drink portfolio.

- Strengthened Competitive Position: The acquisition enhances Celsius’ ability to compete against dominant players like Red Bull, Monster, and Keurig Dr Pepper.

- Revenue Synergies: Alani Nu generated $595 million in revenue in 2024, and the acquisition is expected to add significant topline growth.

- Profitability Boost: The deal is expected to be accretive to earnings in the first full year, with an estimated $50 million in cost synergies over two years.

The acquisition positions Celsius as a major player in the rapidly growing global energy drink market, which is projected to expand at a compound annual growth rate (CAGR) of 10% from 2024 to 2029.

Investor Sentiment and Stock Reaction

The stock’s strong performance after hours suggests that investors see the acquisition as a catalyst for future growth. However, some concerns remain:

Reasons for Optimism

- Strong Retail Sales Growth: Celsius’ retail sales increased 22% year-over-year, indicating continued consumer demand.

- Market Share Expansion: The company gained 160 basis points in market share, reaching an 11.8% share of the energy drink market.

- Operational Efficiency: Gross margin expansion suggests better cost management despite revenue headwinds.

- International Growth: Sales outside North America grew 39%, with strong traction in new markets like the UK, France, and Australia.

Potential Risks

- Profitability Concerns: Net income declined year-over-year, with a reported loss of $18.9 million in Q4.

- Competitive Landscape: Established brands like Monster and Red Bull are aggressively defending market share.

- Integration Risks: Successfully incorporating Alani Nu into Celsius’ business model will be critical for realizing synergies.

- Macroeconomic Headwinds: Consumer spending slowdowns could impact discretionary purchases like energy drinks.

Final Thoughts: A Turning Point for Celsius?

Celsius’ earnings beat and acquisition announcement have reignited investor interest after a period of stock underperformance. The company is making a bold move to solidify its position as a leader in the energy drink space.

While risks remain, the Alani Nu acquisition adds a new dimension to Celsius’ growth strategy. If the company can successfully integrate the brand and sustain its retail expansion, the current rally may mark the beginning of a longer-term uptrend.

Investors will be closely watching the company’s earnings call and upcoming presentation at the Consumer Analyst Group of New York Conference for further insights.

For more details, visit the official Celsius Holdings website.

Leave a Reply