Traders obsess over price movements, technical indicators, and market trends, but one of the most important—and often ignored—factors in trading success is liquidity. Whether you’re trading stocks, crypto, or forex, liquidity determines how easily you can enter and exit positions without causing price slippage.

Understanding liquidity can be the difference between a smooth trade execution and getting stuck in an illiquid asset that won’t let you out without taking a hit. In this article, we’ll break down why liquidity matters, how it affects price action, and what traders can do to use it to their advantage.

What is Liquidity in Trading?

Liquidity refers to how easily an asset can be bought or sold without significantly affecting its price. A highly liquid market has plenty of buyers and sellers, allowing for tight bid-ask spreads, high trading volume, and minimal slippage. On the other hand, an illiquid market has fewer participants, wider spreads, and greater price swings when orders are placed.

Liquidity varies across different markets and assets. Large-cap stocks like Apple or Microsoft trade millions of shares daily, making them extremely liquid, while small-cap or micro-cap stocks may struggle to fill even moderate orders without significant price impact. In crypto, Bitcoin is highly liquid, but obscure altcoins often suffer from low volume and high volatility.

How Liquidity Impacts Trade Execution

For traders, liquidity affects multiple aspects of a trade, including entry, exit, and risk management. Here’s how:

- Order Execution Speed: High liquidity ensures fast order execution at expected prices, while low liquidity can lead to delayed fills and unexpected slippage.

- Bid-Ask Spread: The difference between the buying (bid) and selling (ask) price is smaller in liquid markets, reducing trading costs.

- Price Stability: Highly liquid markets experience smoother price action, while illiquid assets are prone to sharp spikes and drops from even moderate trade volumes.

- Position Sizing: Large orders in an illiquid market can cause major price fluctuations, making it difficult to scale in and out of trades efficiently.

Traders who ignore liquidity risk getting caught in a trade they can’t exit without suffering a substantial loss.

Liquidity and Market Depth: The Hidden Layers of Price Action

Market depth refers to the total volume of buy and sell orders at different price levels. A deep order book provides a buffer against large price swings, while a shallow order book can be easily manipulated.

To visualize this, imagine two scenarios:

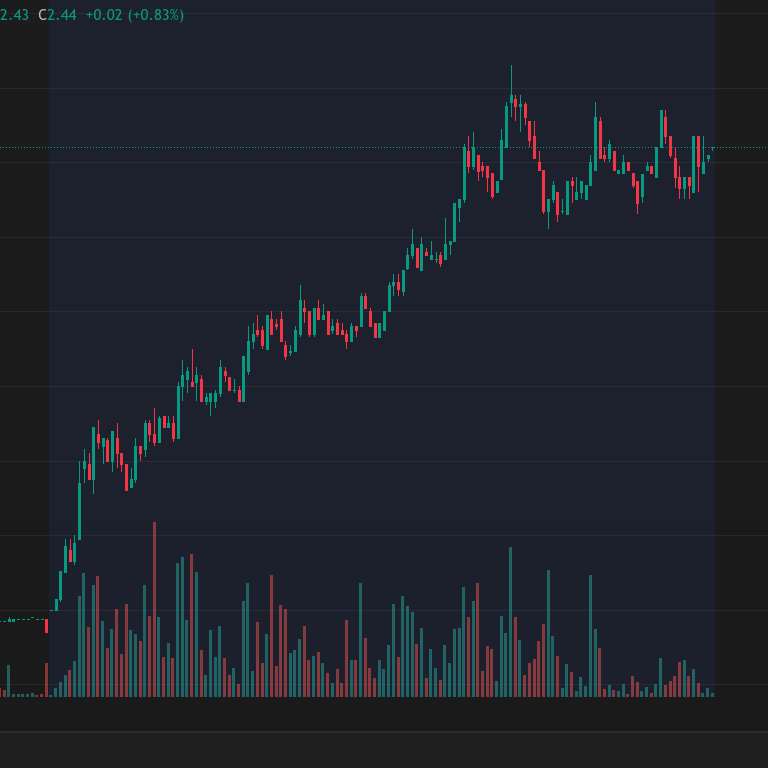

- Deep Liquidity: A stock has millions of shares available at multiple price levels. A large buy or sell order barely moves the price.

- Thin Liquidity: A stock has limited orders on the book. A single large order wipes out multiple levels of liquidity, causing a significant price jump or crash.

This is why institutional traders carefully analyze order book data before placing large trades—they want to ensure their orders won’t significantly move the market.

The Role of Market Makers in Liquidity

Market makers play a critical role in maintaining liquidity. These are firms or individuals that continuously provide buy and sell orders for an asset, ensuring there’s always someone to trade with.

Market makers profit from the bid-ask spread, but their presence helps stabilize prices by reducing sudden liquidity gaps. However, in times of extreme volatility, even market makers can withdraw, leading to flash crashes and massive slippage.

Retail traders often overlook how market makers impact liquidity, but understanding their role can provide insights into price behavior and trade execution.

How to Identify High-Liquidity Trading Opportunities

Since liquidity is essential for smooth trading, knowing how to identify high-liquidity assets can improve execution and reduce risk. Here are key factors to look for:

- Trading Volume: High daily volume means more liquidity and lower slippage.

- Bid-Ask Spread: Narrow spreads indicate high liquidity, while wide spreads suggest low participation.

- Order Book Depth: A thick order book at multiple price levels provides stability.

- Institutional Interest: Stocks and assets favored by institutions generally have more liquidity than those dominated by retail traders.

- Time of Day: Liquidity fluctuates throughout the trading session. For stocks, the first and last hours of trading tend to be the most liquid, while midday sees reduced activity.

By focusing on liquid assets, traders can execute trades with confidence, avoid unnecessary losses, and gain an edge in the market.

The Dangers of Trading Illiquid Assets

Illiquid markets present unique challenges that can catch traders off guard. Here are some of the biggest risks:

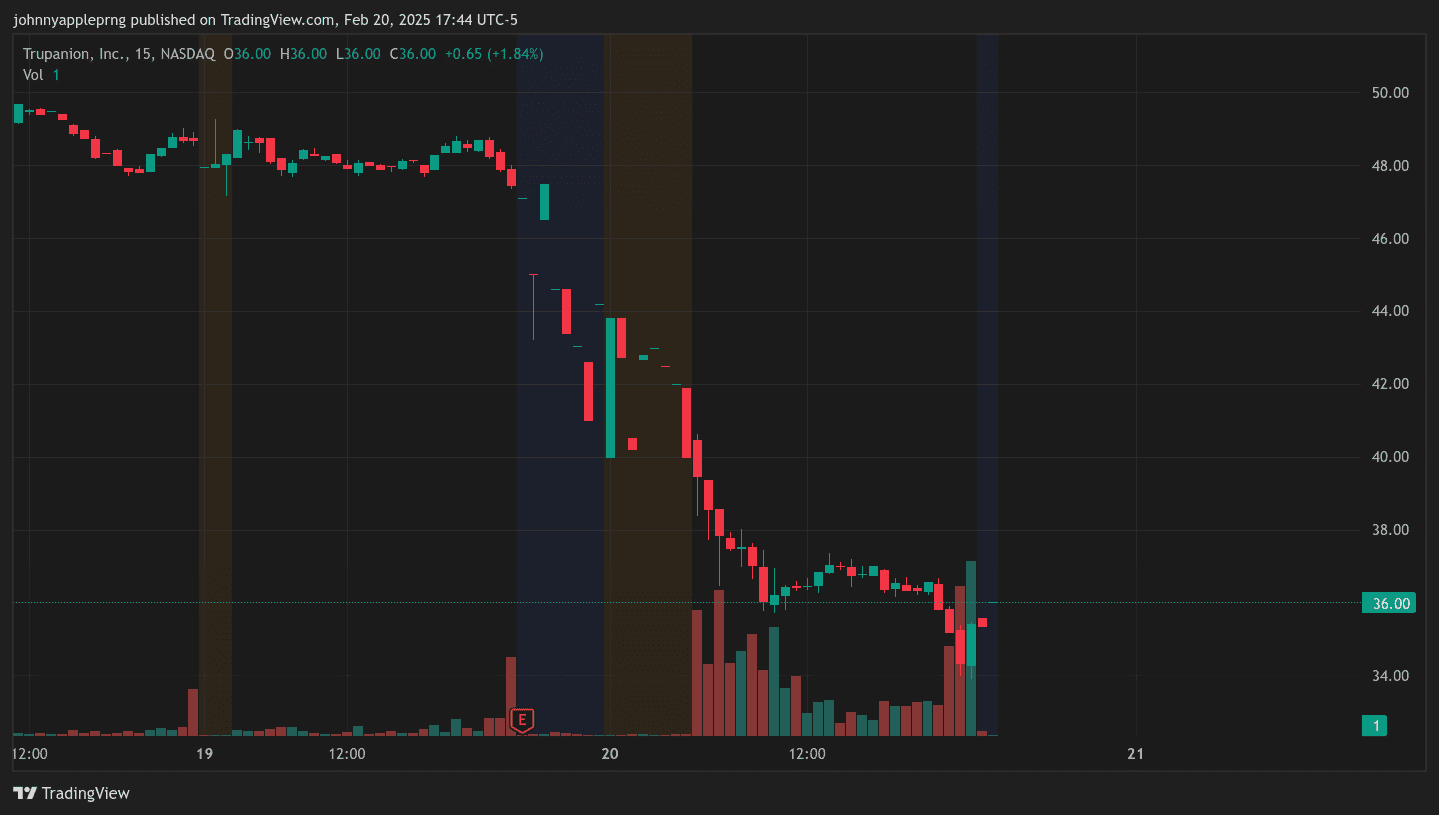

- Extreme Slippage: Large orders in illiquid markets can execute at much worse prices than expected.

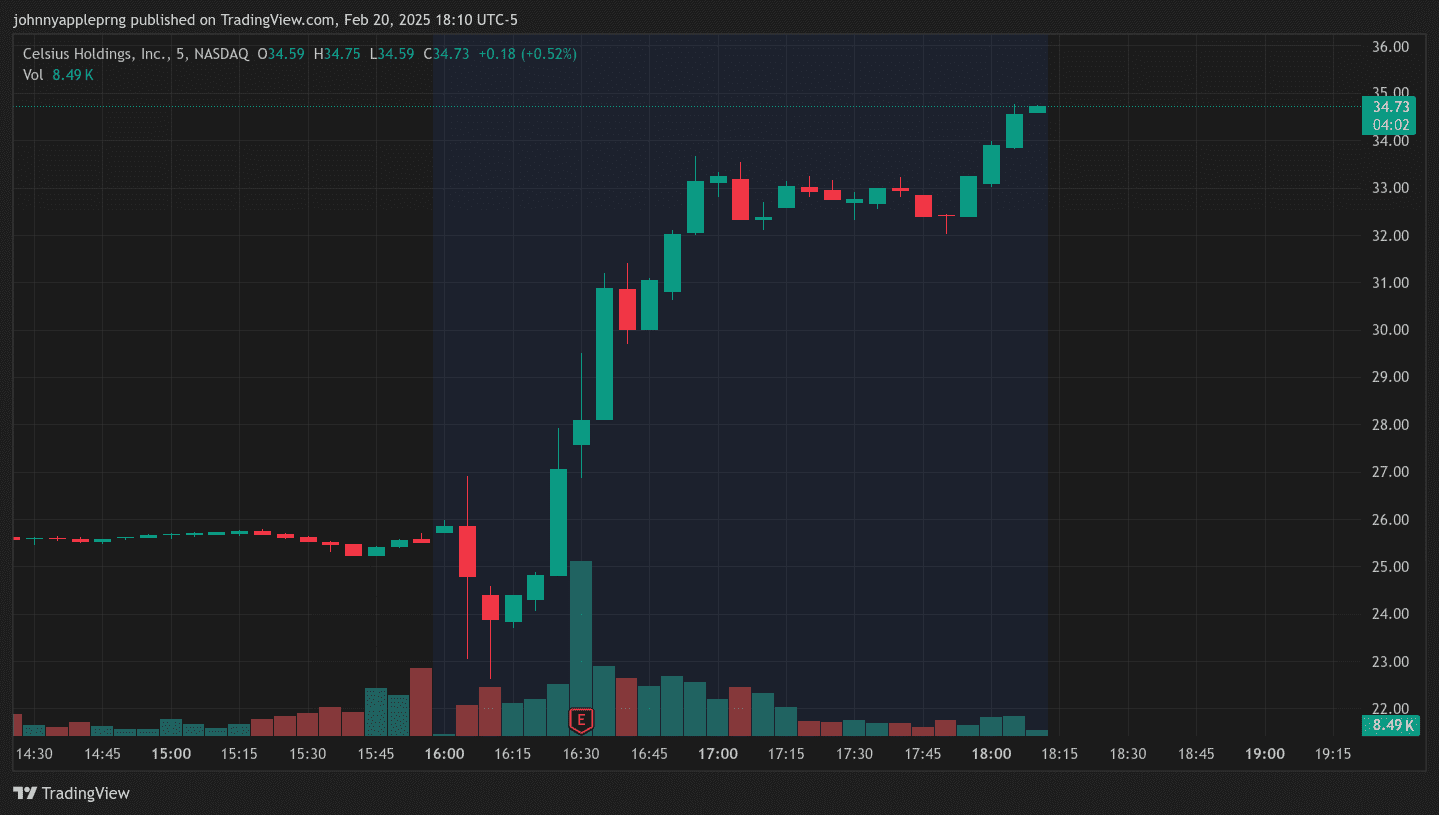

- Manipulation Risk: Low-volume assets are vulnerable to pump-and-dump schemes and sudden price manipulation.

- Difficulty Exiting Trades: Getting into a trade is easy, but exiting can be a nightmare if there aren’t enough buyers.

- False Breakouts: Illiquid stocks often experience wild swings that lure traders into fake moves before reversing sharply.

To avoid these pitfalls, traders should always check liquidity metrics before entering a position.

Final Thoughts

Liquidity is one of the most important, yet overlooked, aspects of trading. It affects trade execution, volatility, and risk management. Without liquidity, even the best trading strategy can fail.

By prioritizing liquid assets, using market depth analysis, and being aware of bid-ask spreads, traders can improve execution quality and avoid unnecessary losses.

Next time you analyze a trade, don’t just look at the price chart—check the liquidity behind it. It could make all the difference between a profitable trade and a costly mistake.