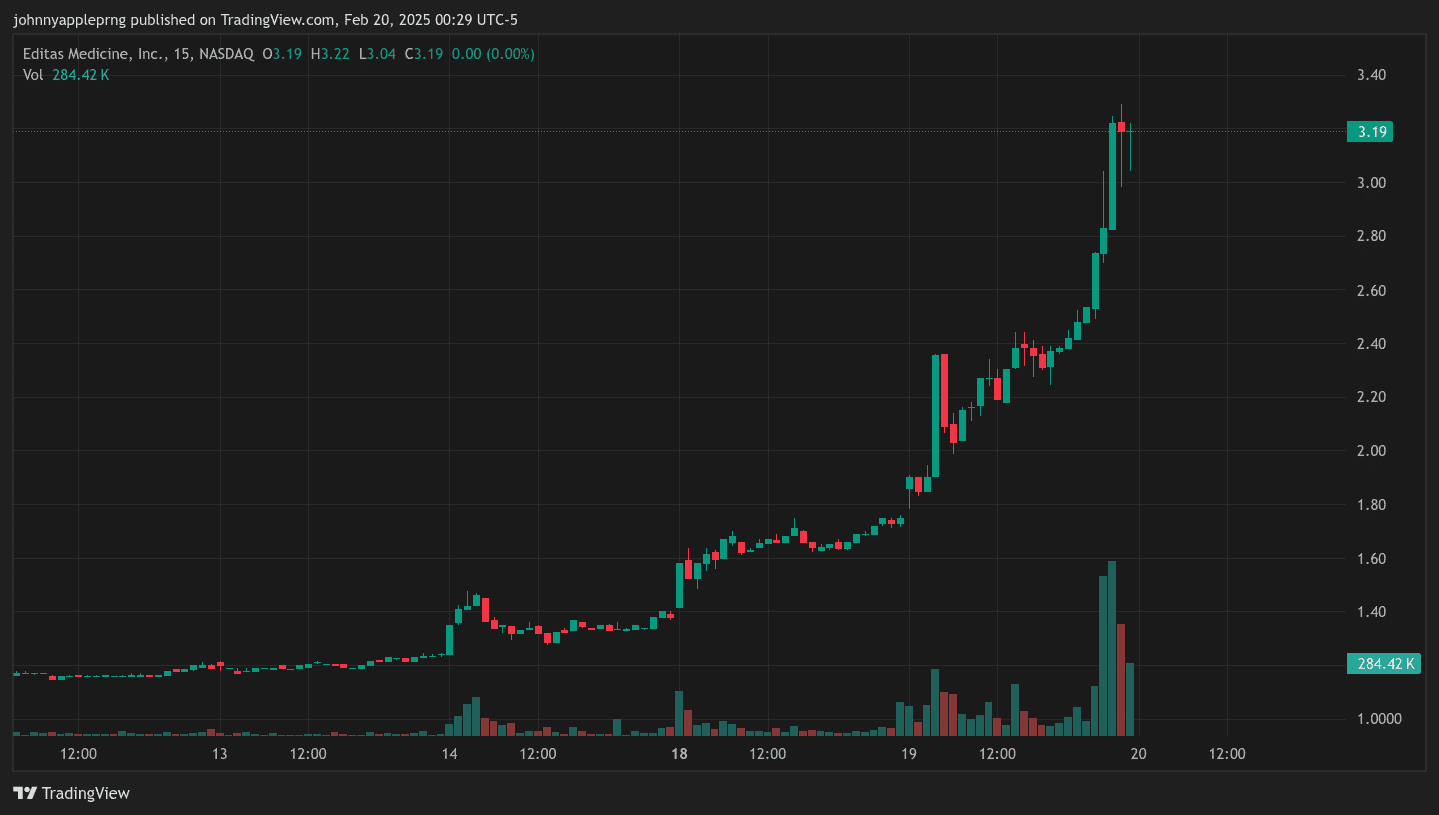

Editas Medicine (NASDAQ: EDIT) has experienced a dramatic price increase, rising from an all-time low of $1.12 to $3.19—an extraordinary 185% gain in a short period. The stock continued to hold its gains in after-hours trading, indicating strong buying pressure.

No major news has been announced, and the company’s next earnings report is scheduled for February 26, 2025, just six days away. With Editas’ financial struggles and recent layoffs, the timing of this move raises significant questions.

Is This an Insider Move?

Editas is a clinical-stage biotech firm specializing in CRISPR-based gene-editing therapies. Despite its groundbreaking potential, the company has yet to generate meaningful revenue and has not posted a profitable year in the past five years.

In December 2024, Editas made a critical decision to end development of its reni-cel program and lay off 65% of its workforce. These moves suggested financial difficulties rather than a company poised for growth, making the recent rally even more unusual.

With no external catalysts driving the price action, this surge could be the result of:

- Institutional accumulation ahead of earnings.

- Speculative trading fueled by momentum traders.

- Insider positioning before a major announcement.

- A coordinated effort to create exit liquidity before another decline.

A Look at the Fundamentals

- Business Model: Editas focuses on CRISPR-based gene therapy for genetic diseases.

- Revenue: Minimal, with funding coming primarily from partnerships and external investment.

- Profitability: Editas has never posted a profitable year.

- Recent Layoffs: In December 2024, the company cut 65% of its workforce and abandoned its reni-cel program.

- Upcoming Earnings Report: February 26, 2025, in just six days.

Despite these financial struggles, Editas has nearly tripled in value. The lack of fundamental improvements suggests this move is more speculative than a sign of a long-term turnaround.

Technical Analysis: Price Action Breakdown

After hitting an all-time low of $1.12, Editas saw a surge in trading volume, driving the price to $3.19. The stock closed near session highs, suggesting strong demand.

Resistance

- $3.20 – A significant level established in October 2024. The stock struggled at this price before continuing its decline, and today’s high-volume battle around this level confirms its importance.

- $5.00 – A longer-term resistance zone from early 2024. If momentum continues beyond $3.20, this would be the next major level to watch.

Support

- $2.50 – The most immediate support level if the stock pulls back.

- $1.12 – The all-time low and a critical level if momentum fades completely.

The stock is currently facing resistance at $3.20. A break above this level could lead to further upside, with $5.00 as the next target. However, if the rally fails, a pullback to $2.50 is likely.

The Bigger Picture: CRISPR, Gene Editing, and the Future of Medicine

The significance of Editas Medicine extends beyond short-term price movements. As one of the pioneering companies in CRISPR gene editing, its research has the potential to transform the treatment of genetic disorders.

What is CRISPR?

CRISPR (Clustered Regularly Interspaced Short Palindromic Repeats) is a revolutionary gene-editing technology that allows scientists to modify DNA with unprecedented precision. By using CRISPR-based therapies, researchers can correct genetic defects, potentially curing inherited diseases.

The Market Potential

Gene editing is still in its early stages, but the market is expected to grow significantly. Companies like Editas, CRISPR Therapeutics, and Intellia Therapeutics are leading the field, with a focus on treating:

- Genetic blindness

- Sickle cell disease

- Beta-thalassemia

- Certain types of cancer

While the potential for life-changing treatments is high, the industry still faces regulatory hurdles, high R&D costs, and uncertainty around long-term effects.

What Comes Next?

Bull Case

- A major partnership or funding announcement could surface before earnings.

- Institutional investors may be positioning ahead of positive developments.

- The company could surprise with stronger-than-expected earnings.

Bear Case

- The stock is being driven up artificially to create exit liquidity.

- Earnings disappoint, leading to a reversal.

- The company’s cash burn remains high, increasing the risk of dilution.

Conclusion

A 185% rally in a struggling biotech stock with no clear news is highly unusual. If there were a fundamental reason behind this move, it would likely be public by now. Instead, the lack of any major announcements suggests this could be a speculative push ahead of earnings.

If this is smart money positioning early, an important catalyst may be coming in the next few days. If not, this could be a temporary surge before another move lower.

With earnings just six days away, this stock is one to watch closely.

Leave a Reply